Understanding How to Select Analytical Instruments in Mexico in 2026

Selecting the right analytical instruments for Mexican operations requires careful consideration of local market conditions, environmental factors, and support infrastructure. With Mexico's growing industrial sector and evolving regulatory landscape, organizations must evaluate multiple criteria including equipment durability, service availability, and technical support options. This comprehensive guide explores the key factors that influence analytical instrument selection in Mexico's diverse industrial environment.

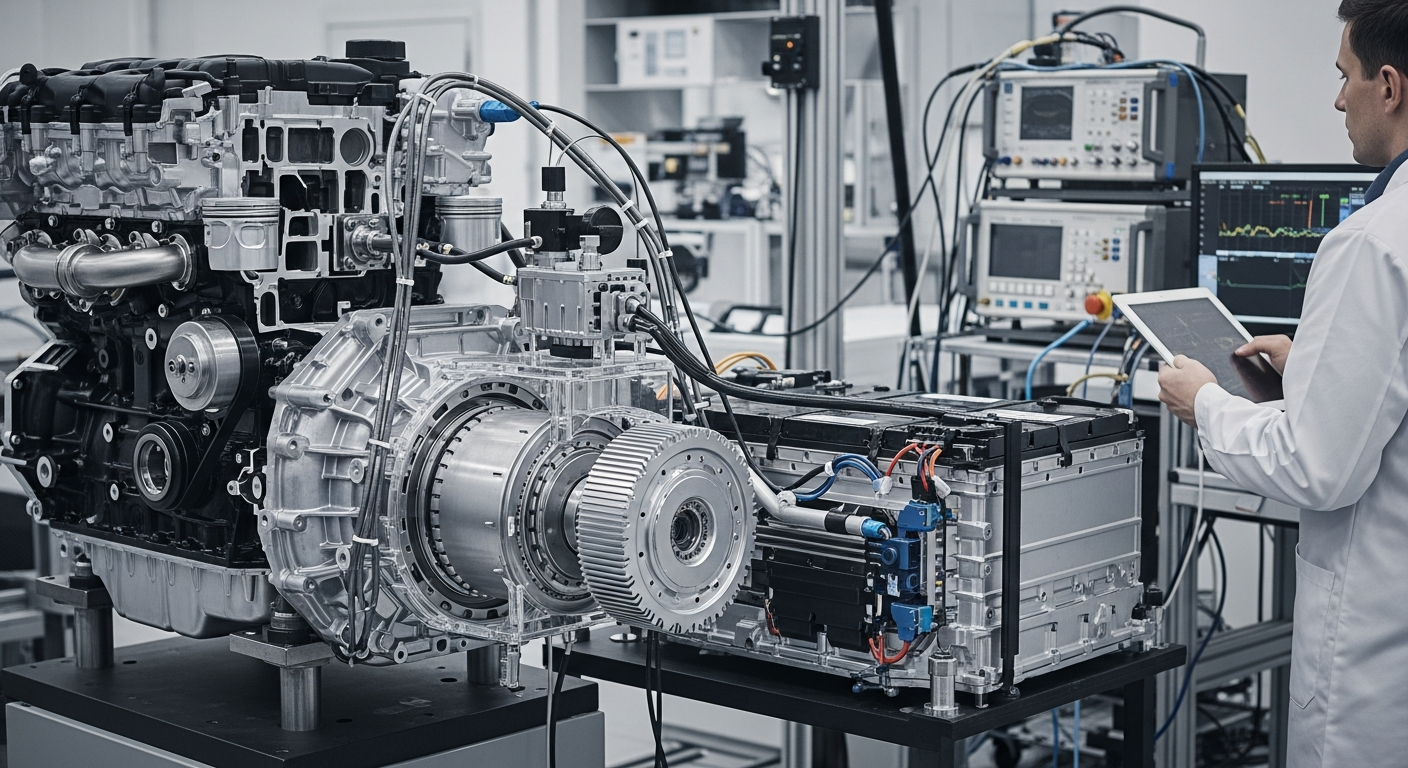

Mexico’s industrial landscape presents unique challenges and opportunities for organizations seeking analytical instruments. The country’s diverse climate zones, ranging from tropical coastal regions to high-altitude mountain areas, create varying environmental conditions that directly impact equipment performance and longevity. Additionally, Mexico’s expanding manufacturing sector, particularly in automotive, pharmaceutical, and chemical industries, drives demand for sophisticated analytical solutions.

Understanding Local Industry Needs in Mexico

Mexico’s industrial sectors have distinct analytical requirements that vary significantly by region and application. The pharmaceutical industry, concentrated in states like Jalisco and Estado de México, requires instruments meeting stringent regulatory standards for drug development and quality control. Meanwhile, the automotive sector, primarily located in northern states, focuses on materials testing and quality assurance equipment. Chemical manufacturing facilities throughout the country need versatile analytical instruments capable of handling diverse sample types and operating under varying environmental conditions. Understanding these sector-specific needs helps organizations align their instrument selection with local market demands and regulatory requirements.

Evaluating Climate Suitability and Durability

Mexico’s geographic diversity creates challenging environmental conditions for analytical instruments. Coastal regions experience high humidity and salt air exposure, requiring instruments with enhanced corrosion resistance and moisture protection. Desert areas in northern Mexico subject equipment to extreme temperature variations and dust infiltration. High-altitude locations present unique challenges including reduced atmospheric pressure and intense UV radiation. Successful instrument selection requires thorough evaluation of environmental specifications, including operating temperature ranges, humidity tolerance, and protection ratings. Equipment manufacturers often provide climate-specific recommendations and modifications to ensure optimal performance in Mexican conditions.

Comparing Cost and Service Availability Locally

Cost considerations for analytical instruments in Mexico extend beyond initial purchase prices to include ongoing operational expenses, maintenance costs, and service availability. Import duties and taxes can significantly impact equipment costs, making locally manufactured or assembled instruments more attractive from a financial perspective. Service availability varies considerably between major metropolitan areas and remote locations, affecting both response times and service costs.

| Instrument Category | Price Range (USD) | Local Service Centers | Import Duty Rate |

|---|---|---|---|

| Spectrophotometers | $15,000 - $80,000 | Mexico City, Guadalajara, Monterrey | 5-10% |

| Chromatography Systems | $25,000 - $150,000 | Mexico City, Tijuana, Puebla | 5-15% |

| Mass Spectrometers | $100,000 - $500,000 | Mexico City, Guadalajara | 10-15% |

| Microscopy Equipment | $20,000 - $200,000 | Mexico City, Monterrey, León | 5-12% |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Considering Training and Language Support Options

Effective instrument operation requires comprehensive training programs and ongoing technical support in appropriate languages. Many international manufacturers now provide Spanish-language documentation, training materials, and technical support specifically for the Mexican market. Local training capabilities vary significantly between suppliers, with some offering on-site training programs while others require users to travel to regional training centers. Organizations should evaluate the availability of Spanish-speaking technical support staff, local training facilities, and translated documentation when selecting instruments. Additionally, certification programs for equipment operators may be required for certain industries, making training availability a critical selection criterion.

Key Suppliers and Service Networks in Major Mexican Cities

Major Mexican cities host established supplier networks and service centers for analytical instruments. Mexico City serves as the primary hub for most international manufacturers, offering comprehensive sales, service, and technical support capabilities. Guadalajara has emerged as a significant secondary market, particularly for electronics and pharmaceutical industries. Monterrey’s proximity to the United States makes it an important distribution point for North American suppliers. Other cities like Tijuana, Puebla, and León have developed specialized supplier networks serving specific industrial clusters. When selecting instruments, organizations should evaluate supplier presence in their operational areas, considering factors such as local inventory availability, response times for service calls, and proximity to spare parts distribution centers.

Successful analytical instrument selection in Mexico requires balancing technical requirements with practical considerations including cost, service availability, and local support infrastructure. Organizations that thoroughly evaluate these factors and engage with established local suppliers typically achieve better long-term results and operational efficiency. The evolving Mexican market continues to offer new opportunities for advanced analytical technologies, making careful supplier and instrument selection increasingly important for competitive advantage.